- TFP 2016 TAX SOFTWARE DOWNLOAD PDF

- TFP 2016 TAX SOFTWARE DOWNLOAD TRIAL

- TFP 2016 TAX SOFTWARE DOWNLOAD PASSWORD

If you take a look at "IRS Publication 1179 General Rules and Specifications for Substitute Forms 1096, 1098, 1099, 5498, W-2G, and 1042-S" you will see this paragraph: I suggest using software called W2 Mate ( ) which is capable of doing just that.

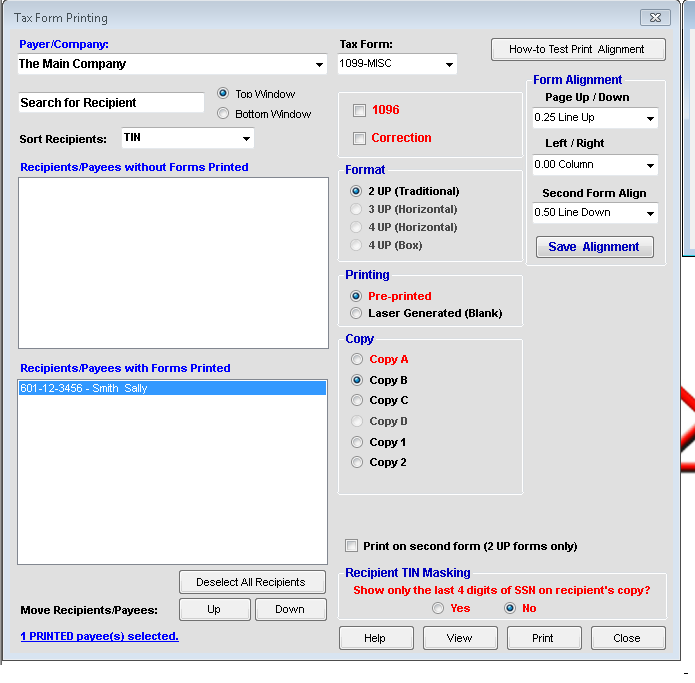

The quick answer is Yes, you can use 1099 DIV Software in order to print a number of form 1099-DIV copies on regular white paper. I get this question a lot from many business owners. To learn more about W2 Mate visit the 1099 software page or visit You can print all copies on white paper (no need for laser forms) except for copy A which you need to print on pre-printed forms. Select the recipients you want to print and type of copy.This will bring up the print 1099-R forms dialog. Click Save before you move between records.Fill out the money amounts for each 1099-R recipient.Under “Form Type” click select and change the form to 1099-R.Click on the “1099 & 1098 Forms” icon from the left toolbar.Repeat step 3 for each recipient you want to add.You will need to select “Form 1099-R” as the type of 1099 forms received. This will bring up the new recipient dialog. Click the new “New 1099 / 1098 Recipient” button.Navigate to the “1099 / 1098 Recipients” page.Open W2 Mate software (W2 Mate prints 1099-R and other 1099 tax forms).Now to the steps for filling out 1099R forms:

TFP 2016 TAX SOFTWARE DOWNLOAD TRIAL

If you have not installed W2 Mate yet, please do so by downloading a FREE trial from the link below: This tutorial assumes that you have either downloaded a FREE demo of 1099R Software called W2 Mate, or you’ve already purchased W2 Mate. This tutorial can be used by businesses and tax professionals wanting to fill out 1099-R forms (Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.).

TFP 2016 TAX SOFTWARE DOWNLOAD PDF

Make sure to review the 1099-K PDF for each recipient.

TFP 2016 TAX SOFTWARE DOWNLOAD PASSWORD

Specify the Password Options if you want to protect the PDF file (recommended).

Click Browse to specify the output folder name where you want your PDF files created. When you are done, click the Save button. Please enter and review all fields carefully.

0 kommentar(er)

0 kommentar(er)